The email lands in your inbox with a thud: another valued customer has decided to end their subscription. Despite your best efforts, customer churn continues to eat away at your revenue and growth potential. For SaaS companies where lifetime value drives profitability, every customer who cancels represents not just lost revenue today, but vanished potential for years to come.

But what if you could identify at-risk customers before they leave? What if you could transform reactive damage control into proactive customer retention?

This guide explains what customer churn is, why it’s important, and how to recognize the 2 main types. Plus, you’ll learn how to build a model to help you predict churn before it happens.

Key insights

Churn is more than a metric—it’s a critical indicator of your product’s health, customer satisfaction, and overall business strategy

The most successful churn reduction strategies combine data-driven insights with proactive customer support approaches

Creating a predictive model transforms churn from an inevitable business challenge into an opportunity for strategic improvement

What is customer churn?

Customer churn, also known as customer attrition, is the percentage of customers who stop using your product or service over a specific period.

In other words, churn happens when existing customers leave, cancel their subscriptions, or choose to shop with your competitor instead. Think of it as the leaky bucket of business—while you pour in new customers through marketing and sales, others drip out the holes at the base.

To calculate customer churn, use this simple formula:

Churn rate = (Customers lost during period / Customers at start of period) x 100

For example, say you run a project management SaaS platform. You start January with 500 active subscriptions, and by the end of the month, 15 companies have canceled their accounts. Your monthly churn rate would be: (15 / 500) x 100 = 3%.

This means you’re losing 3% of your customer base monthly—and potentially 36% annually if this rate continues! Fortunately, even small improvements in churn help improve your revenue and growth trajectory.

Why is customer churn important?

Understanding and managing customer churn is essential for your company’s long-term growth and profitability. Customer churn matters because it

Undermines your revenue: every customer who leaves takes their lifetime value with them

Increases your acquisition costs: with high churn, you have to spend more money to replace customers rather than grow your base

Affects your reputation: rising churn rates often signal deeper product or service issues that could damage your brand reputation if left unaddressed

Slows your growth: a high churn rate means that each new customer acquisition replaces lost customers rather than contributing to actual growth

While churn is a metric every business should watch, it’s even more critical for SaaS companies. Unlike one-time-purchase businesses, SaaS firms depend on recurring revenue and often don’t profit until a customer has subscribed for several months. A customer who churns before reaching their break-even point represents a net loss on your acquisition investment.

2 types of customer churn (and how to avoid them!)

Not all churn is created equal. Thinking about the different types of customer churn helps you develop targeted strategies to address each one.

1. Voluntary churn

Voluntary churn occurs when customers make a conscious decision to stop using your product or service. Also known as active churn, this type typically stems from

Dissatisfaction with product features or functionality

Poor customer service experiences

Finding a better offer from a competitor

Budget constraints or changing priorities

The good news is that, with the right tools, you can watch for signs of customer dissatisfaction and work to prevent it in the future. For example, you might use

Session replays to watch recordings of how users interact with your product to identify common friction points and confusion

Frustration scoring to track user behaviors like rage clicks and form field issues that make customers leave

Net Promoter Score® (NPS®) and customer satisfaction (CSAT) surveys to collect feedback and catch dissatisfaction before it leads to cancellations

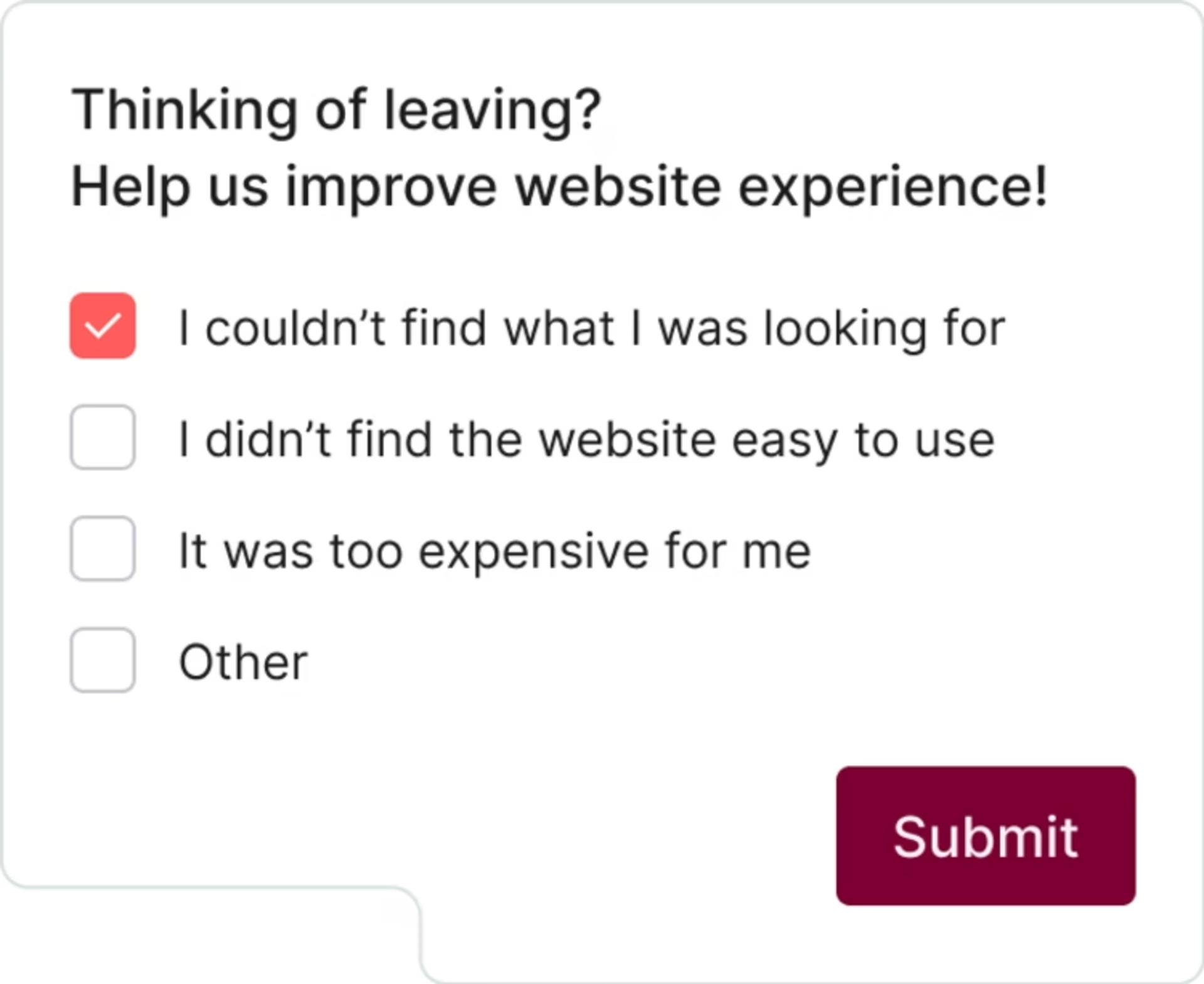

Exit-intent or churn surveys to learn directly from departing customers about why they decided to leave

Use Contentsquare’s exit-intent surveys to learn why customers choose to leave—and prevent future customer churn

2. Involuntary churn

Involuntary churn is when customers unintentionally stop using your service. These customers didn’t choose to leave—they just discontinued due to technical or payment issues.

Also known as passive or silent churn, these departures stem from

Expired credit cards

Failed payment processing

Billing errors or confusion

Account lockouts

Email communication failures

Monitoring your website’s performance is key to preventing involuntary churn. Some strategies that help you do this include

Error analysis to track and resolve issues like JavaScript, application programming interface (API), or user-defined errors that cause customers to walk away

Pre-expiration notifications: alert customers before their payment method expires

Multi-channel communication platforms: to ensure critical account notices reach customers through SMS, email, and in-app messages

Speed analysis to find and fix slow-loading pages to improve the user experience so customers are more likely to stick around

💡 Pro tip: prevent silent churn with synthetic monitoring. This type of monitoring—available with Contentsquare’s Experience Monitoring—lets you proactively test your application’s performance before real users encounter issues. By simulating user journeys across different devices and locations, you identify and fix technical friction points that might drive customers away.

Synthetic monitoring, available as part of Contentsquare’s Experience Monitoring, lets you proactively monitor your site for technical issues that cause churn

4 steps to build an effective customer churn prediction model

A customer churn model uses data to predict which customers are most likely to leave. By analyzing patterns in customer behavior, product usage, and other relevant data points, these models assign a ‘churn risk score’ to each customer. This lets you prioritize your customer retention efforts where they have the biggest impact.

Here are 4 essential steps to building a predictive churn model that actually works.

1. Collect and clean customer data

To predict customer churn, you need to understand what’s currently happening with your customers. This means collecting key information like

Purchase history: what do your customers buy and how often do they buy it? Look for this information in customer relationship management (CRM) tools like Salesforce or HubSpot.

Customer feedback: what do your customers say about your product or their experience? Launch surveys or put a feedback button on any page of your website using Contentsquare’s free Voice of Customer product, or try a social listening tool like Hootsuite to monitor mentions and brand sentiment on social media.

Customer support trends: how often do customers reach out to you, and what tasks or problems do they frequently need help with? Turn to your help desk or customer service platforms like HappyFox or Front.

Engagement patterns: how do customers interact with your website or web app, and what features do they use the most? View session replays and heatmaps from digital experience analytics platforms like Contentsquare.

![[Visual] Heatmaps types](http://images.ctfassets.net/gwbpo1m641r7/44qPX6Nyu2v2i9pGM8JdIE/e1ccfd573959295483bb4b867ca7e57f/Heatmaps___Engagements__3_.png?w=2048&q=100&fit=fill&fm=avif)

See how users engage with your website or web app with Contentsquare’s Heatmaps

Once you’ve collected your data, you need to clean it. Data cleaning involves finding and correcting errors, inconsistencies, or missing values to ensure your data is accurate, complete, and organized. This is important because inaccurate data could lead to unreliable predictions.

Software tools, from Google Sheets to advanced options like Python, automate much of this process, making it easier to prepare your data for customer churn analysis.

2. Look for patterns that increase churn risk

After collecting and cleaning your data, look for warning signs that indicate a customer might be heading for the exit. By identifying common behaviors or features, you start to understand what factors might contribute to churn.

Signs or patterns to look for include

Declining engagement: decreasing log-in frequency, shorter session times, or reduced feature usage

Limited product adoption: customers who never moved past basic features or failed to implement a key functionality

Support ticket patterns: an increase in basic ‘how-to’ questions could signal frustration, while multiple unresolved issues could lead to churn

Negative feedback: declining NPS® or CSAT scores or critical comments on social media

Contract-related behaviors: requests for shorter contract terms or inquiries about cancellation policies

Find patterns by analyzing customers who churn and those who remain loyal. The differences between these groups help you understand the most significant predictors of churn risk in your specific business context.

Pay special attention to combinations of factors that, when occurring together, dramatically increase churn probability. For example, a customer who submits a support ticket about a key feature and shows declining usage might represent a much higher risk of churn than a customer who exhibits just one of these behaviors.

3. Divide your data

Once you have a solid grasp of the features or patterns related to churn, separate your data into two groups:

Training: a set of data you use to ‘teach’ your model how to spot patterns related to churn

Validation: a set of data that tests how well your model works to make sure it’s making accurate predictions

This separation ensures that you create a model with true predictive power. For best results in this step, use data that spans multiple churn cycles to capture seasonal variations or other time-based patterns.

4. Choose and train your model

Now, it’s time to select the right predictive model to put your insights into action.

Several models work well for churn prediction:

Logistic regression: this method predicts the probability of customer churn based on a linear relationship between the features. Since it’s easy to implement and interpret, it makes a good starting point for many businesses, including those with few resources.

Decision trees: these models create a flowchart-like structure that segments customers based on key features, making them helpful for companies that want to understand the ‘why’ behind customer churn in greater detail.

Random forest: by combining multiple decision trees, you improve the accuracy of your predictions. It also reduces overfitting, which is when a model becomes too specific to the training data and doesn’t generalize well. Choose this one if you’re looking for a more advanced model capable of handling large, complex data sets.

Build these formulas by hand if you’re a data scientist or skilled mathematician. Or, do it even faster and with more accuracy with the right customer churn software. With machine learning and artificial intelligence, tools like ChurnZero and Pecan do the heavy lifting for you.

Then, use the training data you set aside in the previous step to train your model. Feed your model examples of input and output data. This helps it understand how the data is related and learn how to accurately predict churn.

5. Validate and improve your model

Testing and validation transform your churn prediction model from a theoretical exercise into a practical business tool. This phase ensures your model actually works in the real world and continues to improve over time.

Remember that validation dataset you set aside earlier? Feed that into your model and see how well it fares.

Here’s what to look for:

Precision: how many of the customers the model predicted would churn actually did?

Recall: how many of the total churned customers did the model accurately identify?

False positives and negatives: understand where your model might be over- or under-predicting churn

If you spot these issues, work on fine-tuning your model. For example, you might need to raise or lower your decision threshold to make it more or less cautious about predicting churn. You might also look for patterns you missed in identifying customer churn features (step 2) or try a different predictive model.

Turn churn into growth

Managing customer churn isn’t just about preventing losses—it’s about improving customer relationships. By developing a data-driven customer churn model, you turn potential departures into opportunities for improvement, personalization, and deeper customer engagement.

Start small, be consistent, and view each churn prediction as a roadmap to better understanding your customers. Your willingness to listen, adapt, and improve is the best way to flip churn around and build a powerful customer retention strategy.