The company

NatWest Group is a banking and financial services company that provides personal, business, and commercial banking to its customers. The company has a strong focus on digital innovation and sustainability.

The challenge

NatWest Group has an online mortgage calculator tool that's a crucial first step in helping customers on their home-buying journey, enabling users to get an agreement in principle (AIP) online.

With over 2.5M completions in the tool each year, AIPs are the lifeblood of NatWest Group’s mortgage business. The company wanted to remove as many user experience (UX) frustrations as possible in the tool to help increase AIP completion rates, because even incremental increases could hugely impact performance.

Contentsquare is at the heart of our decision-making process. Since it’s been introduced to the bank, it has rapidly become a key tool for prioritizing wins for the business and for the customer. Without it, we would have missed a lot of opportunities.It has more than paid its own way and I’m sure it will continue to do so."

The solution

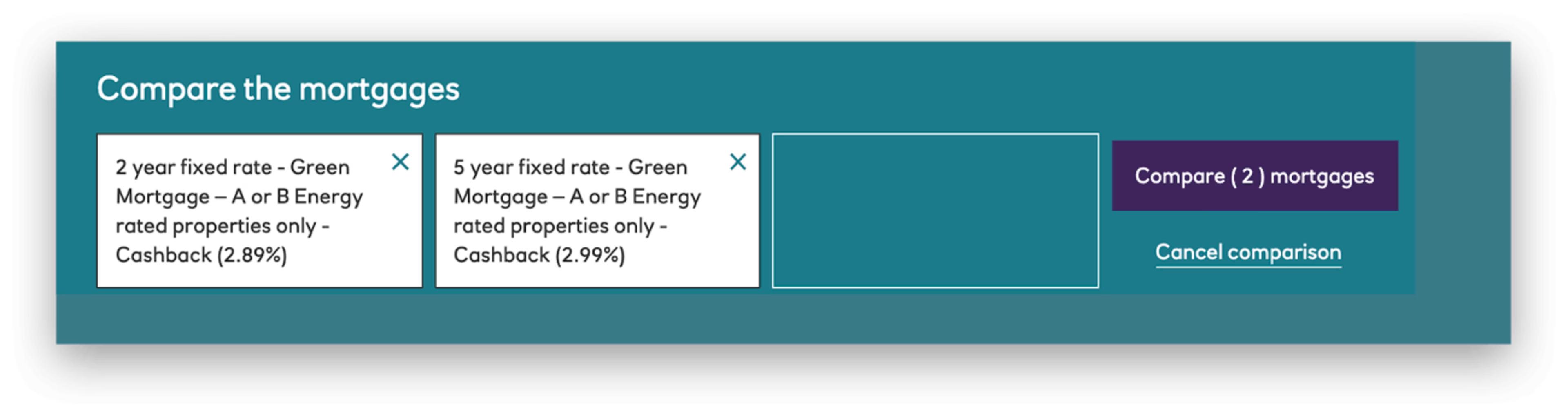

Contentsquare analysis of NatWest Group's customer behavior revealed that the ‘Compare’ functionality in the tool was only being used by 6% of customers. This highlighted an opportunity to replace the rarely used feature with a call to action (CTA) to get an AIP instead.

Contentsquare recommended relegating links to the 'Compare' feature and instead increasing the prominence of the 'Get an Agreement in Principle' CTAs throughout the journey.

NatWest Groups's 'Compare’ functionality before optimization

Thanks to Contentsquare insights, the digital team at NatWest Group made the following changes:

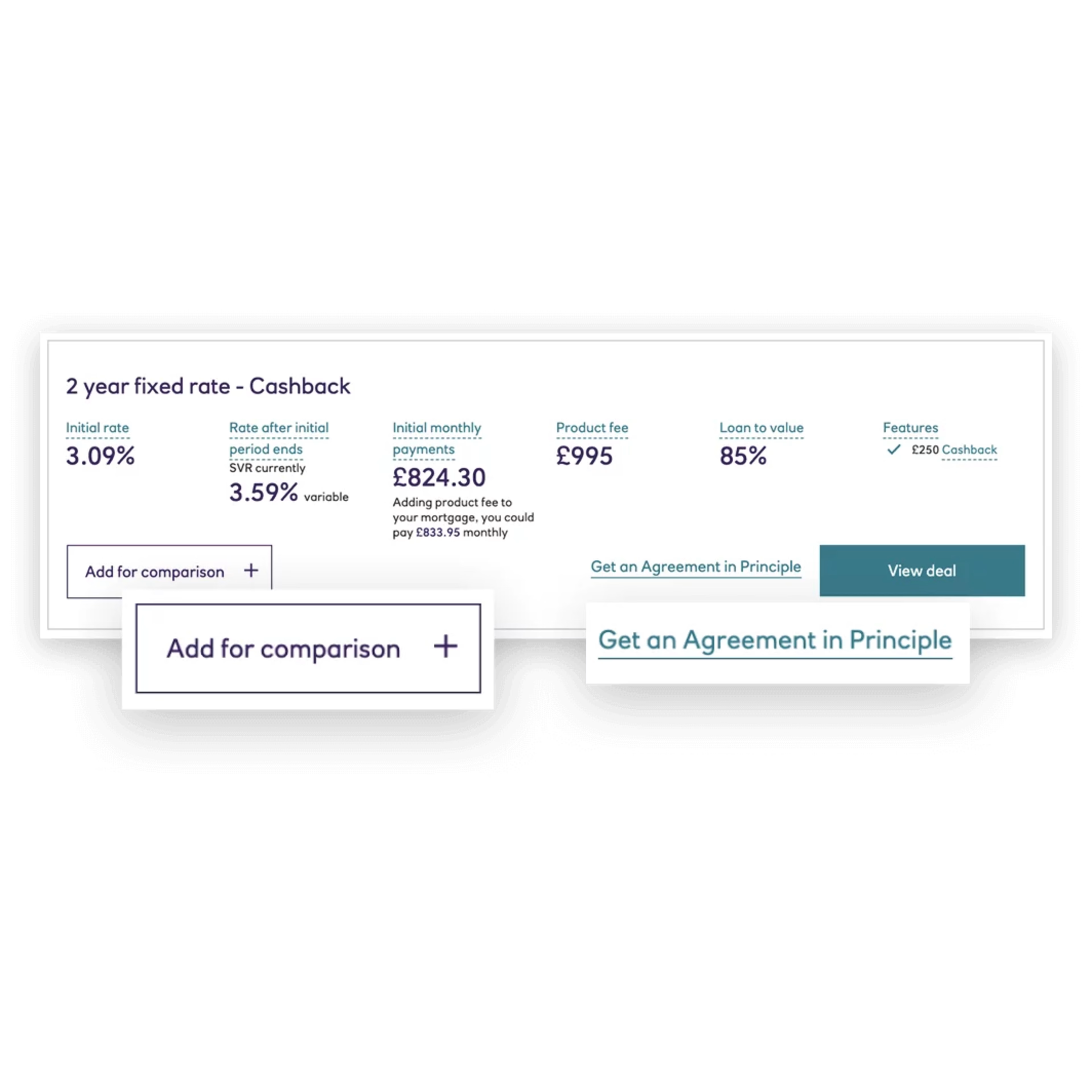

1. Shifting content and CTAs

Shifting the 'Add for Comparison' button across and instead adding a direct link to 'Get an Agreement in Principle' next to the main CTA.

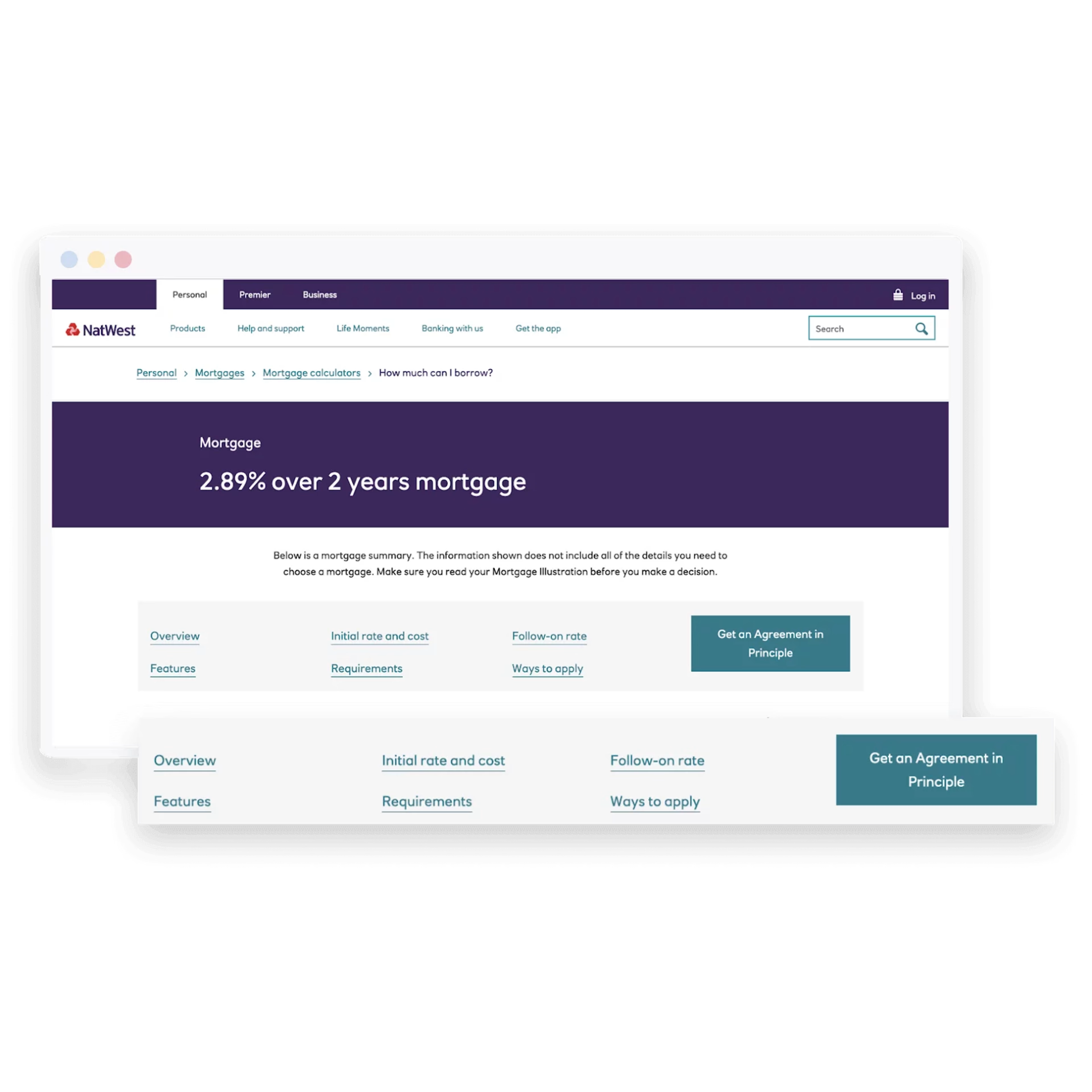

2. Adding new navigation

Adding new product navigation for the 'Apply' customer journey, with the primary CTA to 'Get an Agreement in Principle'.

The results

20% increase in customers completing an AIP

£500k estimated additional revenue. (This figure reflects a snapshot of a single month’s mortgage activity across channels and during a period shaped by COVID-era digital behaviors. Still, even when allowing for post-pandemic shifts, the gains were substantial.)